All Categories

Featured

Table of Contents

- – How do I receive payments from an Fixed Annuit...

- – How can an Income Protection Annuities help me...

- – Who provides the most reliable Guaranteed Ret...

- – Where can I buy affordable Annuity Withdrawal...

- – How do I get started with an Tax-deferred An...

- – How do I get started with an Guaranteed Inco...

For those happy to take a bit more risk, variable annuities supply additional chances to grow your retirement possessions and possibly enhance your retired life income. Variable annuities offer a range of financial investment alternatives overseen by expert money supervisors. Consequently, investors have more flexibility, and can also move possessions from one choice to another without paying taxes on any type of financial investment gains.

* An immediate annuity will certainly not have a build-up stage. Variable annuities provided by Safety Life Insurance Company (PLICO) Nashville, TN, in all states except New york city and in New York City by Safety Life & Annuity Insurance Provider (PLAIC), Birmingham, AL. Stocks supplied by Investment Distributors, Inc. (IDI). IDI is the principal expert for registered insurance products released by PLICO and PLAICO, its associates.

Financiers need to very carefully consider the investment objectives, risks, costs and costs of a variable annuity and the underlying investment options before spending. This and other details is included in the prospectuses for a variable annuity and its underlying financial investment choices. Programs may be acquired by getting in touch with PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a protection or supply market financial investment and does not take part in any kind of supply or equity investments.

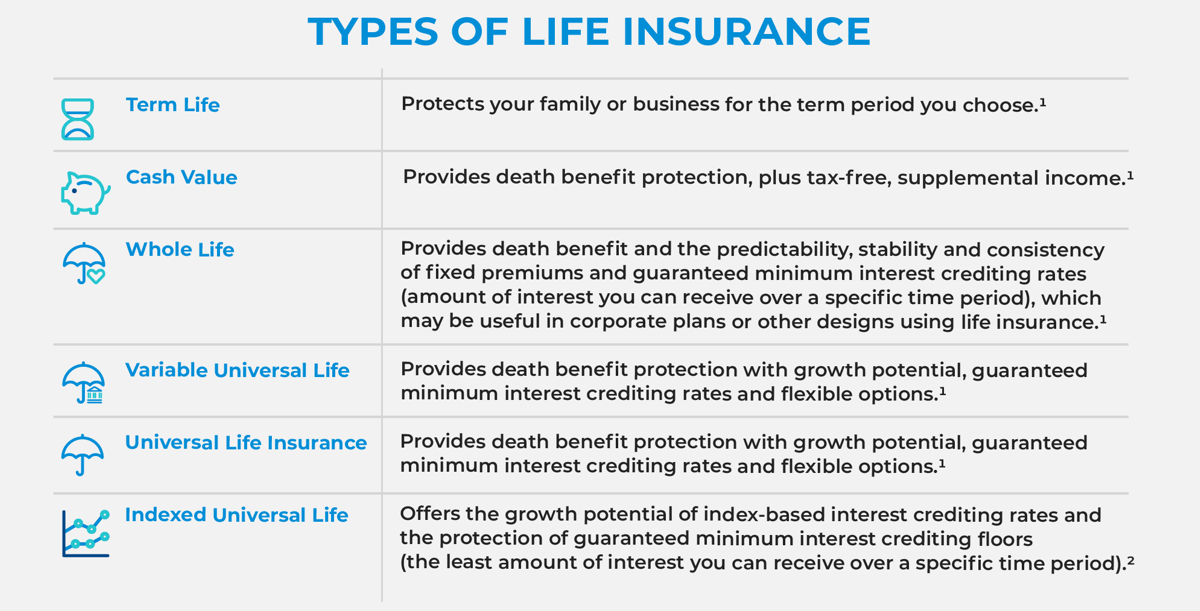

What's the distinction in between life insurance policy and annuities? It's a common inquiry. If you wonder what it takes to protect an economic future for yourself and those you love, it might be one you discover on your own asking. Which's an excellent point. The lower line: life insurance coverage can aid give your enjoyed ones with the economic assurance they deserve if you were to pass away.

How do I receive payments from an Fixed Annuities?

Both must be thought about as part of a lasting monetary strategy. Although both share some similarities, the total purpose of each is very various. Let's take a peek. When contrasting life insurance policy and annuities, the largest difference is that life insurance policy is created to aid protect versus a financial loss for others after your death.

If you wish to learn even more life insurance coverage, checked out the specifics of how life insurance policy works. Consider an annuity as a tool that could assist meet your retirement needs. The main objective of annuities is to develop revenue for you, and this can be done in a few different methods.

How can an Income Protection Annuities help me with estate planning?

There are many possible advantages of annuities. Some include: The capacity to expand account value on a tax-deferred basis The capacity for a future revenue stream that can't be outlived The possibility of a swelling sum benefit that can be paid to a making it through spouse You can acquire an annuity by offering your insurance provider either a solitary round figure or paying in time.

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

People typically buy annuities to have a retirement revenue or to construct cost savings for one more purpose. You can acquire an annuity from a certified life insurance policy representative, insurer, economic planner, or broker. You need to speak to a financial advisor concerning your requirements and objectives before you acquire an annuity.

Who provides the most reliable Guaranteed Return Annuities options?

The distinction between the 2 is when annuity repayments begin. permit you to conserve money for retirement or various other factors. You do not need to pay tax obligations on your revenues, or payments if your annuity is a private retirement account (IRA), till you withdraw the earnings. allow you to develop an income stream.

Deferred and instant annuities supply numerous options you can pick from. The options give different levels of potential danger and return: are guaranteed to gain a minimal passion price.

enable you to select between sub accounts that resemble mutual funds. You can earn extra, but there isn't an assured return. Variable annuities are higher risk due to the fact that there's a chance you might lose some or every one of your money. Fixed annuities aren't as high-risk as variable annuities since the investment risk is with the insurance coverage business, not you.

If performance is low, the insurer births the loss. Set annuities assure a minimum rates of interest, usually between 1% and 3%. The company may pay a greater rates of interest than the guaranteed rates of interest. The insurance policy business establishes the passion rates, which can transform monthly, quarterly, semiannually, or yearly.

Where can I buy affordable Annuity Withdrawal Options?

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are extra complicated than repaired postponed annuities (Fixed annuities).

Each relies upon the index term, which is when the company calculates the rate of interest and credit scores it to your annuity. The figures out just how much of the rise in the index will certainly be used to compute the index-linked passion. Various other important functions of indexed annuities consist of: Some annuities cover the index-linked rate of interest rate.

Not all annuities have a flooring. All fixed annuities have a minimum surefire value.

How do I get started with an Tax-deferred Annuities?

Various other annuities pay substance rate of interest during a term. Compound passion is interest gained on the cash you conserved and the rate of interest you make.

If you take out all your cash prior to the end of the term, some annuities won't credit the index-linked interest. Some annuities could attribute just component of the passion.

How do I get started with an Guaranteed Income Annuities?

This is because you birth the investment danger rather than the insurer. Your agent or monetary adviser can help you make a decision whether a variable annuity is appropriate for you. The Securities and Exchange Compensation categorizes variable annuities as protections since the performance is stemmed from stocks, bonds, and other financial investments.

An annuity contract has two phases: a buildup stage and a payout stage. You have a number of choices on just how you add to an annuity, depending on the annuity you purchase: enable you to select the time and amount of the repayment.

Table of Contents

- – How do I receive payments from an Fixed Annuit...

- – How can an Income Protection Annuities help me...

- – Who provides the most reliable Guaranteed Ret...

- – Where can I buy affordable Annuity Withdrawal...

- – How do I get started with an Tax-deferred An...

- – How do I get started with an Guaranteed Inco...

Latest Posts

How do I cancel my Annuity Contracts?

Long-term Care Annuities

How can an Guaranteed Income Annuities help me with estate planning?

More

Latest Posts

How do I cancel my Annuity Contracts?

Long-term Care Annuities

How can an Guaranteed Income Annuities help me with estate planning?